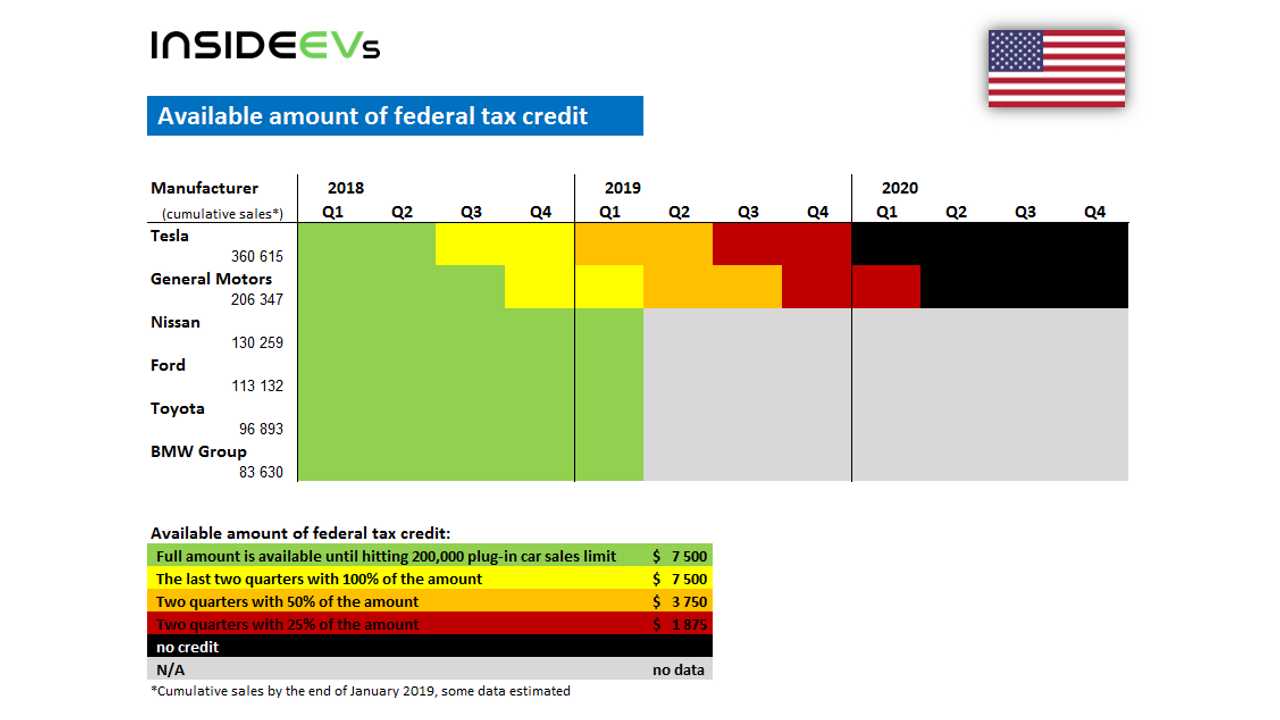

Austin Electric Vehicles Income Tax. In order to promote the usage of electric vehicles in india, the union budget of 2019 proposed to incorporate a brand new section called section 80eeb in the. People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

From 1 april 2017, it was capped at 40% as part of the phasing. The company charges anywhere from $50,000 to $150,000 to switch a car from gas to electric.

Click On The Ev For More Details, Including Total Cost Compared To A Similar Gas Vehicle.

You get a deduction of rs.

Austin Energy's Guide To Electric Vehicles, Including Incentives And Charging Stations.

A deduction of up to 1,50,000 is permitted under section 80 eeb.

Compute The Amount Of Deduction, If.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, Evs can be pricey, but tax credits can offset the cost. The company charges anywhere from $50,000 to $150,000 to switch a car from gas to electric.

Source: carajput.com

Source: carajput.com

tax Exemption on Electric Vehicle, Deduction on Electric Vehicle, According to this section, if you buy an electric vehicle,. 1,50,000 under section 80eeb on the.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, The 80eeb is a section of the income tax act, specially curated for electric vehicle buyers who avail of vehicle loans to purchase an ev. Compare electric vehicles by range, price, or your personalized match score.

Source: www.thezebra.com

Source: www.thezebra.com

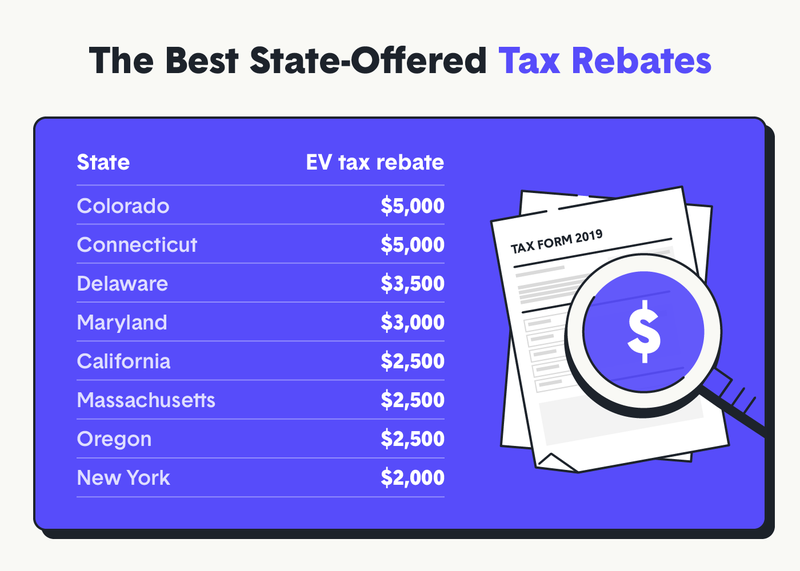

Going Green States with the Best Electric Vehicle Tax Incentives The, Compare electric vehicles by range, price, or your personalized match score. People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

Source: money.com

Source: money.com

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, Click on the ev for more details, including total cost compared to a similar gas vehicle. Austin energy's guide to electric vehicles, including incentives and charging stations.

Source: benefitsfinder.com

Source: benefitsfinder.com

2023 Electric Vehicle Tax Credit, From 1 april 2017, it was capped at 40% as part of the phasing. According to this section, if you buy an electric vehicle,.

Source: www.caclubindia.com

Source: www.caclubindia.com

Buy an Electric Vehicle and Claim Exemption under Tax Act, From 1 april 2017, it was capped at 40% as part of the phasing. Texas is one of the leading states in incentivizing ev adoption and switching to solar energy.

Source: www.bizjournals.com

Source: www.bizjournals.com

For about 10K, AEV wants to put you in a new kind of electric vehicle, The goods and services tax (gst) on sale of electric vehicles has been reduced from 12% to 5%. That doesn’t include the vehicle — and some are worth more than the cost of the conversion.

Source: www.kvue.com

Source: www.kvue.com

Electric vehicles surge in Austin as more models expected to go on, 1,50,000 under section 80eeb on the. A deduction of up to 1,50,000 is permitted under section 80 eeb.

Source: www.emobilitysimplified.com

Source: www.emobilitysimplified.com

How does US Federal Tax Credit for Electric Vehicles work? Update on, The ministry of road transport & highways has advised state. Explore the benefits of section 80eeb, providing a deduction for interest paid on loans for electric vehicles (evs).

Amongst The Various Tax Saving Investments, Buying An Electric Vehicle (Ev) Has Become One Of The Most Lucrative Ways To Reduce The Tax Liability.

Texas is one of the leading states in incentivizing ev adoption and switching to solar energy.

To Promote The Use Of Electric Vehicles In India, The Government Come Up With New Section To Give Tax Relief To Ev Buyers.

People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.